Millennials are being ‘left behind,’ and it poses a huge risk to the US economy

http://ift.tt/2ydfebI

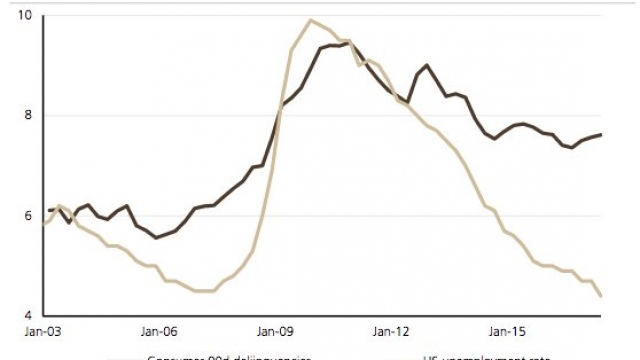

The labor market is improving, and yet consumer

delinquencies are creeping up.

UBS

The unemployment rate dropped to 4.2% in September, its

lowest since February 2001, and yet consumer

loan defaults keep creeping up.

In fact, the divergence between the labor market on one hand, and

consumer credit performance on the other, is at a

record. What figures?

UBS analysts led by Matthew Mish and Stephen Caprio set out

to answer that question, and their findings highlight the

financial difficulties many millennials are facing.

According to Mish and Caprio, there are two cohorts

that have been left behind by the labor market: lower income

households, and millennials.

“The most underappreciated factor explaining consumer stress is

the two-speed recovery in US consumer finances,” they said.

The two strategists dived into the Fed’s latest Survey of

Consumer Finances to calculate a bunch of metrics,

including the the levels of debt to assets and income

across across different age cohorts. Those ratios are near record

levels, with the millennial debt-to-income ratios in line with

2007 levels.

The debt-to-assets ratio for millennials is

soaring

UBS

And that might not tell the whole story. The Fed survey suggests

38% of student loans are not making payment, while the structural

shift from owning a home and paying a mortgage to renting means

that more households are paying rent and making auto lease

payments. In other words, they might have significant outgoings

that aren’t being captured in the debt figures.

“We believe this is particularly problematic when assessing the

financial obligation ratios of US millennials and lower income

consumers,” UBS said.

So what does this mean? Here’s UBS:

“Longer term, the two-tier recovery in consumer finances suggests

key segments of the US population (lower income, millennial

households) are more financially vulnerable than aggregate

consumer credit metrics imply. In turn, these groups will be

more sensitive to fluctuations in labor market conditions and

interest rates ceteris paribus.”

That’s a touch worrying, especially at a time when interest rates

are going up.

For context, millennials hold 18% of debt outstanding, according

to UBS, and make up 19% of annual consumer expenditures.

Together, the two cohorts “left behind,” lower income households

and millennials, make up about 15% to 20% of debt, and 27% to 33%

of expenditure.

So if they’re struggling, it has the potential to negatively

impact the economy pretty significantly.

Millennials make up a big chunk of the consumers citing

a loan default in the next 12 months.

UBS

business

via Business Insider http://ift.tt/eKERsB