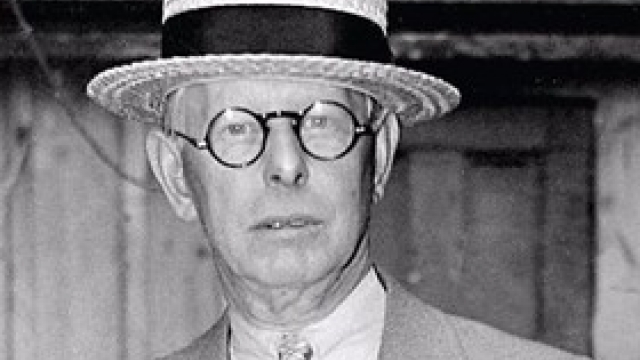

Beat the System: Why Jesse Livermore, who made a mint in the Crash of 1929, would buy bitcoin today

http://ift.tt/2z3Rm9F

Buy bitcoin.

That’s not my advice. It’s the advice of one of Wall Street’s most famous traders and speculators, Jesse Livermore.

And he’s been dead for 77 years.

The price of bitcoin set yet another new high Thursday, breaking through $5,000 for the first time. The so-called cryptocurrency has been in a massive boom all year, rocketing from just below $1,000 in January and crashing twice along the way.

My opinion is that bitcoin has absolutely no intrinsic value, and its long-term investment case makes no compelling sense. Many, obviously, take the opposing view. But it doesn’t really matter. This article is not about the long-term investment case.

It’s about trading. Even if bitcoin is a bubble, is it going to keep going higher before it eventually bursts? Is there free money to be made?

For one answer, I decided to consult Wall Street’s most famous trader. It was in 1923 that the journalist Edwin Lefevre first published his classic biography of the American trader Jesse Livermore, “Reminiscences of a Stock Operator.”

Read: Five things to do when every investment is too expensive

Livermore described the experiences he had learned making, and losing, several fortunes by trading on Wall Street since the 1890s. He is most famous, perhaps, for selling short U.S. stocks before they crashed in 1929, swelling his bank account to $100 million. Livermore never encountered cryptocurrencies, obviously. He traded in stocks and commodities.

But his thoughts sound relevant today. So what advice does he give?

• It doesn’t matter that cryptocurrencies are completely new. They are still being bought and sold in a market — for money. So the way to trade them is the way to trade anything. “There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

• Think like a trader, not an investor. “The speculator is not an investor. His object is not to secure a steady return on his money at a good rate of interest, but to profit by either a rise or a fall in the price of whatever he may be speculating in.”

• Ignore the long-term fundamentals; just look at the current price action. “When a man makes his play in a commodity market, he must not permit himself set opinions. He must have an open mind and flexibility. It is not wise to disregard the message of the tape, no matter what your opinion of crop conditions or of the probable demand may be.”

• Go with the flow. “I never hesitate to tell a man that I am bullish or bearish. In a bear market, all stocks do down and in a bull market they go up.”

And it’s usually pretty obvious which one you’re in if you are keeping an open mind. “Prices … move along the line of least resistance. They will do whatever comes easiest, therefore they will go up if there is less resistance to an advance than to a decline; and vice versa.”

Traders, he said, should “watch the tape, establish your resistance points, and be ready to trade along the line of least resistance as soon as you have determined it.”

• If you’re a trader, don’t be put off by high prices or wish you’d gotten into the market lower. “Remember that stocks are never too high for you to begin buying or too low to begin selling.”

He actually preferred to pay “top prices” for stocks when buying for a rise, because he believed a stock that had made a new high was more likely to make yet more.

• Don’t be worried that bitcoin just broke $5,000 — be cheered. “When a stock crosses 100 or 200 or 300 (dollars) for the first time, the price does not stop at the even figure but goes a good deal higher, so that if you buy it as soon as it crosses the line it is almost certain to show you a profit.”

• When you jump on a bandwagon like this, do so in stages. “In starting a movement it is unwise to take on your full line unless you are convinced that conditions are exactly right. … After the initial transaction, don’t make a second unless the first shows you a profit. Wait and watch.”

In the main, Livermore said a speculator should wait until the line of least resistance had established itself, then invest one-fifth of his planned stake, and wait till that shows a profit before adding the second-fifth.

The cryptomania may yet turn out to be the nuttiest financial madness since the dot-com bubble — or even more so. But for speculators, the nuttier, the better. The crazier people get, the quicker they will give away their money.

business

via MarketWatch.com – Top Stories http://ift.tt/dPxWU8