Need to Know: Oil headed to $10? China may be in the driver’s seat

http://ift.tt/2hJUCjC

So another week begins, and many investors may be wondering how many records will be broken now — at least those that have nothing to do with Mother Nature.

That synchronized global uptrend is looking pretty intact, with almost every major world equity index at or near record highs. Asia has kept that going, and the Dow looks set for a fresh high this morning. Note that it’s been an incredible 236 days since the S&P 500 has had a decline of at least 3%.

This so-called “euphoriameter” says it all:

4. On a similar note the #Euphoriameter has reached the highest point since 2000. https://t.co/0mtBnVXKoF $SPX $VIX http://pic.twitter.com/ymYb5gnHwA

— Callum Thomas (@Callum_Thomas) October 14, 2017

But alas, not all assets have been joining the party. Oil — incidentally trekking up this morning on unrest in Iraq and questions about the Iran nuclear deal — is set to finish the year with a whimper.

That leads us to our call of the day, which predicts things won’t get better for crude prices. In fact, they will probably get much worse thanks to China, according to Nick Cunningham, who tracks oil and the renewable energy beat.

“As the world’s largest auto market, China’s EV (electric-vehicle) policy, which is still being formulated, could supercharge the race for EVs,” says Cunningham in a blog post for Oilprice.com.

He rattles off a number of signs of China’s electric-car gear-up, such as big planned investments and a growing clampdown on autos that cloud its skies with pollution.

“It will only take a small change in oil demand to upend price forecasts. After all, prices crashed in 2014, falling from $100 per barrel down to $50 in less than a year,” he says.

Cunningham points to a Financial Times report that says China plans to produce 7 million EVs per year by 2025 and to spend at least $60 billion on related subsidies between 2015 and 2020.

And a Bloomberg New Energy Finance report that predicts EVs will cut crude demand by 8 million barrels a day by 2040 should “send chills down the spines of oil executives,” he warns.

Cunningham was expanding on a prediction made by Chris Watling, who believes growing interest in alternative energy fuels could drive oil prices to $10 a barrel over the next six to eight years.

The Longview Economics chief told CNBC on Friday that a key catalyst would be Saudi Aramco’s IPO — planned for later 2018, but now looking in doubt — saying they “need to get it away quickly before oil hits $10 a barrel.”

Cunningham didn’t lay out when oil might take a hit from the Middle Kingdom’s EV push, but seemed to see it as a sure thing.

“The exact point we reach peak oil demand is obviously very debatable, but in general, the mass adoption of EVs could permanently keep oil prices low, even under some relatively modest assumptions about the growth of the EV market,” he says. Read the full post here.

Key market gauges

DJIA

, S&P 500

and Nasdaq

futures are all steady, but just a small rise for the Dow

would leave blue chips in record territory.

As mentioned, WTI crude

and Brent

prices are trekking higher, driven in part by fear fighting between Iraq and Kurdish separatists will disrupt supplies. Gold

and silver

The dollar

is moving up against the euro

, after Catalonia’s leader defied Madrid’s demand for clarity on independence. Spanish stocks

are weighing on the rest of Europe

In Asia

, the Hang Seng Index

closed at a 10-year high.

See the Market Snapshot column for more.

The chart

In among that Asia cheer, the Nikkei 225 index

nabbed another 21-year high on Monday. While it may be hard for U.S. investors to get excited about Japanese stocks, MKM Partner’s chief market technician Jonathan Krinsky says they could be missing a big opportunity here.

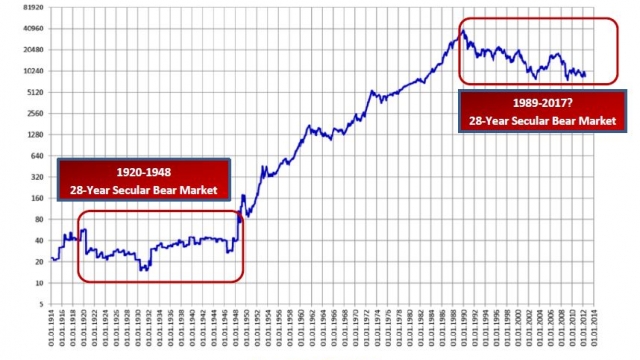

He explains that Japanese stocks’ secular cycles are longer than the 15-to-20 years seen in the U.S. The last bear market ran for 28 years, and that’s how long the current bear market has been around, as this chart shows.

MKM Partners Wikipedia

Here’s what he has to say about the second chart: “Whether or not you want to call an end to the secular bear in Japan, it’s clear that the Nikkei is in a strong uptrend now.”

“There is an entire generation that has not witnessed a secular bull market for Japanese equities. The fact that Japan is breaking above a 25+ year secular trading range should not be taken lightly, in our view.”

MKM Partners

Note that a snap general election in Japan is set for Sunday. Here’s all you need to know about that.

The buzz

Apple

got upgraded to overweight at KeyBanc Capital Market. It set a price target of $187 for the iPhone maker, citing a more “aggressive market segmentation strategy.”

A busy earnings week kicks off with Netflix

after the close. The streaming service is forecast to report earnings of 32 cents a share — 167% higher on the year and up more than 113% on the quarter.

Bitcoin

, which went roaring higher last week, is sitting just over $5,600. WikiLeaks founder Julian Assange over the weekend had this to say about a big bump he’s seen in his bitcoin investment:

My deepest thanks to the US government, Senator McCain and Senator Lieberman for pushing Visa, MasterCard, Payal, AmEx, Mooneybookers, et al, into erecting an illegal banking blockade against @WikiLeaks starting in 2010. It caused us to invest in Bitcoin — with > 50000% return. http://pic.twitter.com/9i8D69yxLC

— Julian Assange 🔹 (@JulianAssange) October 14, 2017

An oil platform operated by Clovelly Oil exploded Sunday in Lake Pontchartrain near New Orleans, causing multiple injuries.

Data from China showed producer prices shot up 6.9%, the latest surprise out of the country.

Ophelia, which was the most powerful hurricane seen so far east in the Atlantic, has weakened but is still putting Ireland on lockdown:

Today is a day that people are going to learn an awful lot about their employer #Ophelia

— Pádraic Keogh (@patkeogh) October 16, 2017

The economy

The data calendar is less packed this week, but we will get some updates on housing starts and sales, along with the Fed’s beige book. For Monday, the Empire State index is due at 8:30 a.m. Eastern Time.

Check out our economic preview for the week.

Meanwhile, Fed Chairwoman Janet Yellen left open the possibility of further interest rate rises in 2017, speaking at a Group of 30 banking seminar on Sunday.

The quote

“A lot of people thought I was probably exaggerating it, but now we are worried and Congress is worried about whether they can take that power away from Trump so that in a moment of pique he doesn’t pick up that phone and call whoever is sitting in the control center today.” — That was Hillary Clinton telling a London audience on Sunday evening that she’s worried POTUS could launch a nuclear missile.

Random reads

Good news for Napa, where firefighters say they’ve “turned a corner”

But in Galicia, Spain, more than 100 fires are burning

Hoy no amanece en Oviedo… todo huele a quemado, se ve ceniza en el aire y hasta hace calor de ir en manga corta. Son las 9:15 de la mañana y no hay claridad aún… #AsturiesArde #GaliciaArde 😔 http://pic.twitter.com/DXv7IbLIlP

— Víctor Gallego (@repanark) October 16, 2017

Colin Kaepernick says NFL owners have colluded not to hire him

Larry Flint offering $10 million for info that leads to POTUS’s impeachment

So I decided to do this…let’s see what happens. http://pic.twitter.com/Xpy4qrwHU7

— Larry Flynt (@ImLarryFlynt) October 15, 2017

Woody Allen says Weinstein scandal is “sad,” worries about a Hollywood ‘witch hunt’

Right-wing parties scored some victories in Austria this weekend

Microsoft is building tree houses for its employees

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. Be sure to check the Need to Know item. The emailed version will be sent out at about 7:30 a.m. Eastern.

business

via MarketWatch.com – Top Stories http://ift.tt/dPxWU8