Jeff Reeves’s Strength in Numbers: These 3 stocks are smart bets on the artificial intelligence revolution

http://ift.tt/2gkGInD

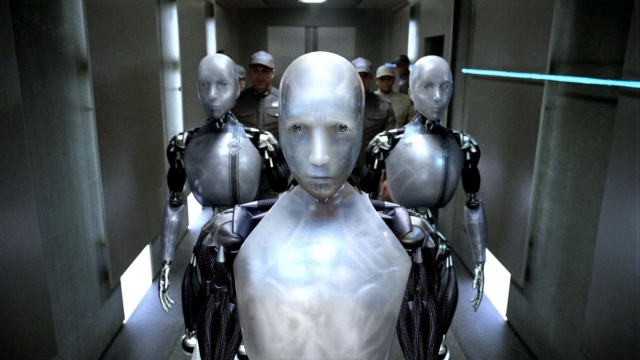

“Artificial intelligence” is a misunderstood term, thanks in part to dystopian views of the technology across pop culture — from the iconic Terminator to Cylons in Battlestar Galactica to HAL 9000 in 2001: A Space Odyssey.

In reality, most scientists working on artificial intelligence aren’t trying to simulate true human intelligence at all. They are simply trying to create practical machines capable of analyzing data and making decisions to achieve a goal.

Case in point — Salesforce.com

has a valuable artificial intelligence application called Einstein that it provides to clients. This AI engine helps marketing and sales teams by suggesting which customers are the most valuable, and which products they are most likely to buy.

Not only is that a far-less sinister example of AI, it’s also exemplary of how businesses can use this technology to create serious profits. Salesforce stock, for example, is up 40% year-to-date compared with less than 15% for the broader S&P 500

.

In fact, the most practical applications of artificial intelligence are side-by-side with Big Data and cloud-computing applications that many investors are already familiar with. Think of artificial intelligence as just the natural next step now that we’ve created all this data — something has to make sense of it.

For example, retailers have been trying for years to harness the predictive power of your shopping habits in order to put offers in front of you. Case-in-point: A now-infamous story about

investing in how to predict when a customer was (or soon would become) pregnant.

While fears of the robot apocalypse may never completely disappear from pop culture, the business case for AI is clear in this age of information. The only question is who will provide the artificial intelligence engines of the future, and which companies and investors will profit.

If you’re interested in playing this emerging-tech trend, here are three AI plays to consider:

Alphabet

Google parent Alphabet Inc.

made a splash a few years ago as it seemed to be diving into deep machine learning with the acquisition of DNNresearch, DeepMind Technologies, and JetPac among others.

The flurry of acquisitions in 2013 and 2014 made waves at the time, and in the near term were seen as incrementally improving areas of Google’s internet business, such as improving search or providing better bidding on ad rates. But the tech giant hasn’t taken its eye off the ball in the intervening years, and overlooking its long-term commitment to AI would be a mistake.

Just like it has cemented its role in the smartphone ecosystem with its Android operating system, Google is pushing hard to share its open-source TensorFlow machine learning software with developers and companies of all sizes

While many companies like Amazon.com

are using AI internally to improve customer experience or to create products like voice assistant Alexa, Google has opened up the gates and is welcoming the world into its AI ecosystem.

We’ve seen this blueprint before, where Google was happy to allow a community of smart, driven experts to help it build Android to be a world leader in mobile software. You could do worse than bet they would do the same thing with their artificial intelligence platform.

Sure, there’s no material profits yet. But if AI becomes the next big Google platform, running the systems in homes and cars the way Android runs tablets and phones, Alphabet will surely find a way to capitalize on that in the years ahead.

IBM

The opposite of Google’s approach is the proprietary Watson system created by International Business Machines Corp.

Many Americans are most familiar with Watson for its trivia skills displayed on television show “Jeopardy.” But aside from quirky PR stunts, the supercomputer has found a role performing much more practical tasks in recent years.

Since 2013, for example, Watson has been in use at Memorial Sloan-Kettering Cancer Center in New York to help oncologists make the best decisions based on mountains of medical records and real-life diagnoses. And last January a Japanese insurance firm became so reliant on Watson’s actuarial skills that it laid off a few dozen human employees.

IBM has married a powerful machine learning interface with its existing enterprise tech operation, selling Watson’s AI under the “software-as-a-service model” that has been so profitable for cloud computing firms in recent years. It’s a natural iteration for IBM’s business — and a necessary one, too, as the struggling technology giant sees persistent revenue headwinds and increasingly is looking to both the cloud and artificial intelligence results to boost performance. The company just reported its 22nd consecutive quarter of revenue declines, though it did beat on profits thanks in part to 20% growth in its cloud division.

When you marry the strategic imperatives of cloud and AI with the existing scale and reach of IBM, it’s hard to imagine that the company will not be a serious play in AI for years to come. Furthermore, a 10-year partnership with MIT launched this year will all but ensure a generation of eager engineers come into the American workforce with ready skills to deploy Watson at their workplaces.

This is not as sexy or as grandiose as Google’s plan to democratize AI and spread it around the world. But for investors, the appeal is IBM’s bright line between this emerging technology and near-term profit potential.

Robotics and AI ETF

If you’re unwilling to pick a winner in the race for artificial intelligence applications, I don’t blame you. Emerging technologies are not just hard to fully understand, but they are tumultuous businesses where upstarts can come out of nowhere and leaders can fall from grace.

That’s where the Global X Robotics & Artificial Intelligence ETF

comes in. This unique and diversified ETF invests in companies “that potentially stand to benefit from increased adoption and utilization of robotics and artificial intelligence.”

Because this spans all applications, it makes for an intriguing portfolio. Top holdings now include Nvidia Corp.

for its leading Drive PX platform that can power self-driving cars, Japanese “smart factory” supplier Omron Corp.

and medical robotics company Cyberdyne

to name a few.

The most interesting thing about these holdings is that they aren’t nebulous plays on some general AI theme and the hope of machine learning on a grand scale. Most are profiting now with targeted business models that marry automation and AI to produce real-world results.

For this strategy the ETF charges a rather modest 0.68% expense ratio, or $68 annually on $10,000 invested. That seems a small price to pay for a diversified and thoughtful basket of potential AI winners.

business

via MarketWatch.com – Top Stories http://ift.tt/dPxWU8